This year, more than ever, we can all do with saving a bit more money and tightening up our spendings. Knowing where to start can be tricky, though, and monthly expenses can quickly spiral out of control. Here are six tips that you can put into action right now to save you money in the long run.

1. Shop right.

Saving money doesn’t mean you need to stop buying new things for yourself. It just means you need to know how to shop smart. Make the most of flash sales and avoid new arrivals. Look for offers or clearance sales on the women rack of clothes, or shop at stores where you can earn exclusive rewards for loyalty shopping. Making the most of these thrifty fashion options is a great way to look fabulous, with access to stylish jackets and sneakers, without draining your savings.

2. Check your essentials.

We can sometimes get into the habit of just accepting our monthly costs as given, but there are often savings to be found in our regular bills. Money Gains is a tool that can help you find ways of cutting down on electricity tariffs, as one example, to make sure you are getting the best deal possible. For services that you can’t avoid paying for, like gas and electricity, making sure you get the best deal possible is vital.

3. Plan ahead.

Having a bit of foresight can help you save in various areas, so make forward planning a part of your lifestyle as soon as possible. Plan your meals for the week and buy only what you need to reduce food waste. Set goals for certain purchases ahead of time, so that you can set aside the right amount and don’t end up with surprise charges on your credit cards. Looking forward and staying on top of what comes out of your account each week is the first step towards cutting down on your spending.

4. Swap with friends.

One way to make the most out of what you already have is to swap unwanted clothes, furniture, glassware, or other items with friends. If there’s something you need that’s out of your price range, see if you can trade or borrow it from friends. Take to online community pages to make a new friend through trading useful objects. Not only does this reduce your spending, but it also clears out your own home from unwanted items that are only taking up space.

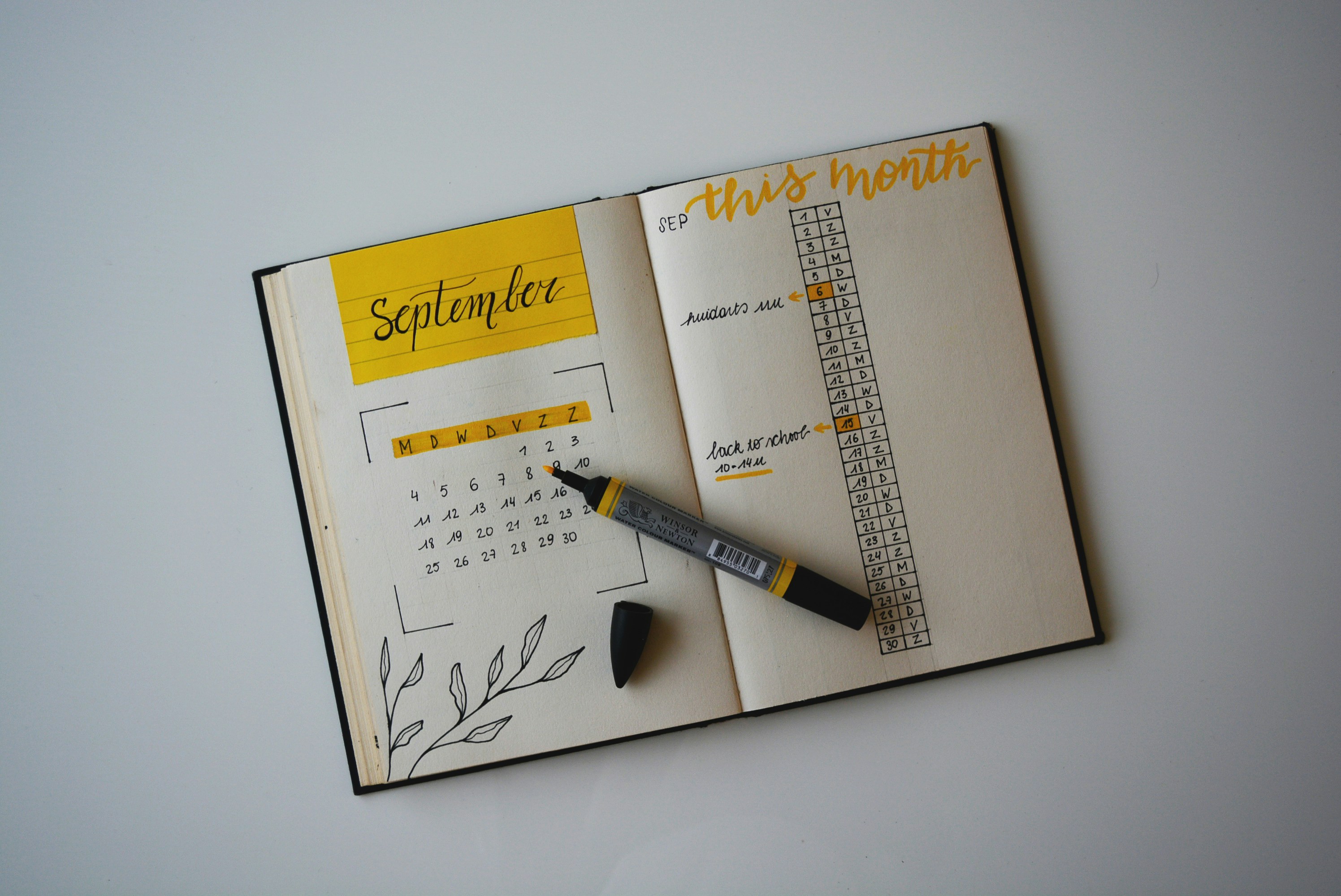

5. Keep careful records.

The most important step you need to take when it comes to saving money it to keep track of your finances. You cannot improve on a situation if you don’t fully understand it. Create a spreadsheet of all your income and expenses, down to the last penny. You might think that you know what’s going on in your bank account, but even small costs can add up to unexpectedly high expenses without you realizing it. Once you have everything laid out in front of you, you can see where savings can be made.

6. Out of sight, out of mind.

Put money where you can’t see it. Creating a savings account is all well and good, but if you have easy access to it, it’s often too tempting to simply pull money out of it again when you’re in a pinch. Put your savings in a closed account, or at least one that you can’t access from your phone. It needs to be tricky enough to look at that it makes you think twice before withdrawing money from it. At the same time, make sure it’s easy to put money into, to make it work in your favor.