Budgeting considerations are a major hurdle for many homeowners looking to create financial independence that will last a lifetime. Spending needs often get in the way of a strong cash flow, and emergencies can creep up on you with little to no warning. The truth is that most Americans couldn’t handle a $1,000 emergency purchase without going into debt—with the use of a credit card in most instances.

It doesn’t have to be this way. There are many things you can do to create financial security for yourself and your family today. They start with a strong budget and a commitment to lowering payments going out.

Think of your money on a pie chart.

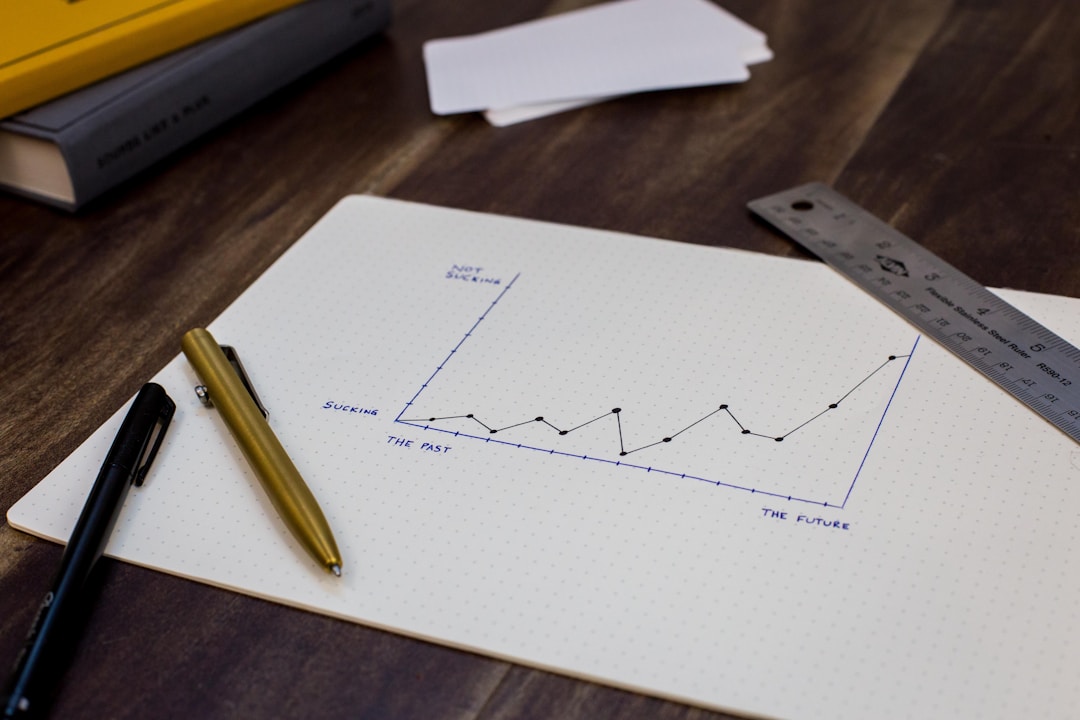

Many homeowners consider their personal finances as a math equation on a bar graph. Mentally, a bar graph is one of the easiest ways to represent data, and our minds immediately jump to this type of representation in order to measure expenditures against one another. But this isn’t an efficient way to think about personal finance. Creating a spreadsheet with your expenses and earnings and then manipulating the Excel or other software program to create a physical pie chart representation of your finances is a much stronger path to financial freedom.

The pie chart gives you the data in percentages. Rather than stacking your mortgage payments or rent responsibilities up against the cable bill or car insurance, you should be thinking of the percent of your total income that each of these expenses gobble up. By visualizing the data in this way, you can begin to look for tangible ways to reduce outgoing spending and transfer more of it into growing your savings slice of the pie.

Think of savings as payments to your future self.

Whether you’re hoping to find ways of building your dream home on a budget or want to save up for a new dress or suit to wear to your next formal dinner party, savings offer a powerful way to break up these major expenses over the course of many years. The best way to approach the savings you need is to think of this as paying your future self. Putting away money today removes it from your checking account for now, but it gives you greater buying power for the future, especially if you invest it in smart growth assets that outperform the reduction that inflation factors into a standard savings rate.

Saving is the best way to easily afford self-care purchases, like lingerie sets for the holiday season that you and your loved one can enjoy—ideally in the new home you’ve been saving for over the last year.

Invest in long-lasting products.

Many people think about reducing the cost of purchases by either buying products for the lowest price on the market or by doing research into the longest-lasting product, regardless of the price. There is a happy medium to be found here in all industries from magnetic lashes and other beauty products to new tile or countertops for the kitchen.

Magnetic lash solutions are a great way to get the best of both worlds. Lash products tend to fall on one side of this fence or the other: you end up with cheap, single-use lashes, or long-lasting and expensive lash products. Magnetic eyelashes or magnetic eyeliner straddles this divide perfectly. Magnetic lashes are long-lasting and cost-effective, giving you the best of both worlds of lash and eyeliner solutions.

Whether you’re saving for a special occasion or a new floor plan update to your existing or a new home, creating a strong savings strategy is crucial to financial freedom.